Revenue adjustments – Progress/Fixed fee projects

Revenue adjustments capabilities has been built on top fee management allowing us to adjust the accrued revenue getting the correct total revenue as well as WIP and % complete at given point of time. There could be scenarios where the actual work completed is more or less than then what’s been already billed to the client, in this case you can use the revenue adjustment capabilities bring back the project values to what’s expected.

There are two type of the adjustments namely – percentage complete adjustment and NTE adjustment each catering to different fee types. Percentage complete adjustment is applicable to the projects with the fee type of progress or fixed fee where as NTE adjustment is applicable to projects with the fee type of time and expense NTE.

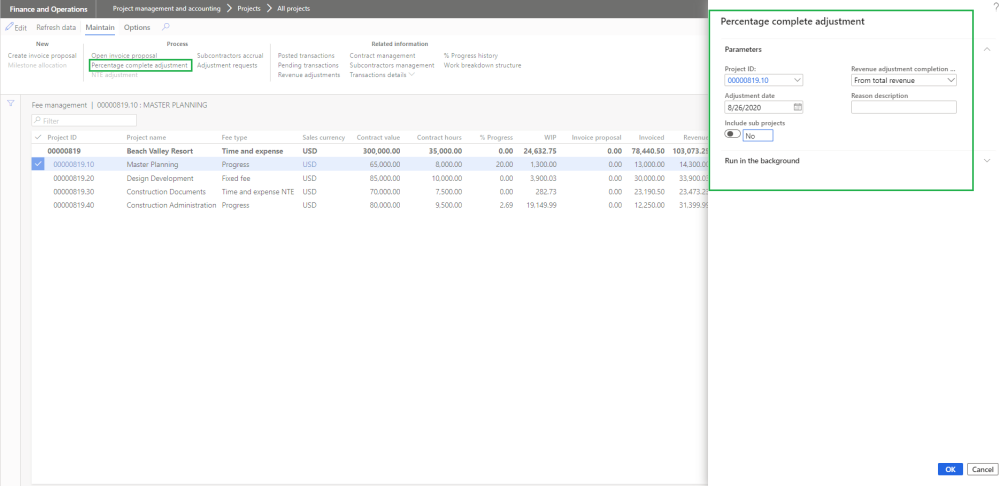

Go to Project management and accounting > All Projects > Fee management -> Percentage complete adjustment

Once user select progress fee type project, Percentage complete adjustment button is enabled allowing users to perform revenue adjustment.

While performing the adjustments, there are 5 different methods to adjust the project values.

- From total revenue – In this case an adjustment record is created considering the total revenue earned, this includes the invoiced as well as the accrued revenue vs total contract value of the project as on the day of adjustment. A record is created on the revenue adjustments form.

- From Invoice revenue – In this case an adjustment record is created considering the posted/invoiced revenue vs the total contract of the project as on the day of adjustment. A record is created on the revenue adjustments form.

- From total hours – In this case an adjustment record is created considering the posted hours vs the hour budget the project as on the day of adjustment. A record is created on the revenue adjustments form.

- From contract value cap – In this case an adjustment record is created considering the percentage complete revenue adjustment calculation. A record is created on the revenue adjustments form.

- From estimated at completion – In this case an adjustment record is created considering the estimated at completion percent vs total contract value of the project as on the day of adjustment. A record is created on the revenue adjustments form. This option is available and defaulted when “Activate ETC/EAC management” projects360 parameter is set as “Yes”. Also users can use the adjustment date as the cut-off date to calculate the actuals during the revenue adjustment process.

- From effective cost multiplier – In this case an adjustment record is created considering the effective cost multiple for the project as on the day of adjustment. A record is created on the revenue adjustments form. This option is available and defaulted when “Activate ETC/EAC management” projects360 parameter is set as “Yes” and “ETC/EAC cost multiplier” projects360 parameters are set as “Yes”. Also users can use the adjustment date as the cut-off date to calculate the actuals during the revenue adjustment process.

- From main project effective % complete – In this case, an adjustment record is generated based on the effective % complete of the main project linked to the selected project. The revenue adjustment record will reflect the ‘adjusted percentage complete’ using the “Effective % complete” from the main project. Note: “Effective % complete” is available in the “ETC/EAC management” form.

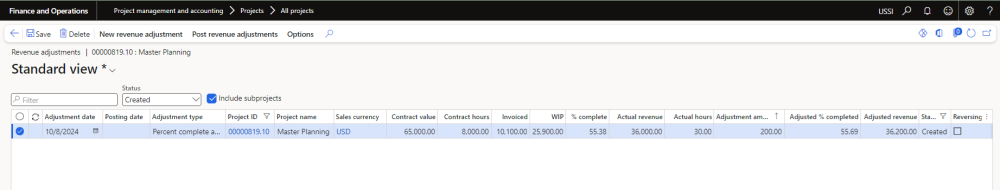

Once an adjustment record is created, user can update the ‘Adjustment amount’ and ‘Adjusted % completed’ to adjust the project balances. On updating the ‘Adjustment amount’ and ‘Adjusted % completed’ fields, the rest of the column values are auto calculated to reflect the right values. Once you sure of the adjustment values, you can update the reason description and can post multiple revenue adjustments with the posting date and this is posting date is reflected on the revenue adjustment form.

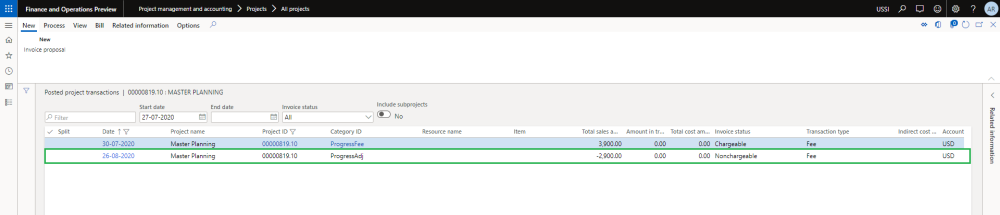

On posting a revenue adjustment, a fee journal is created in system. This fee journal uses the category defined on projects360 parameters.

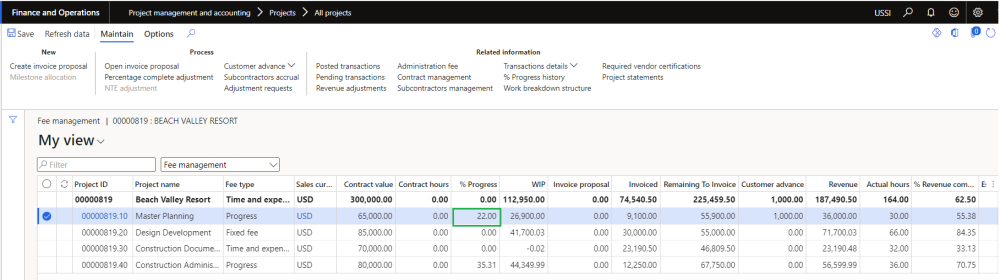

Once the revenue adjustments are posted and complete, you can see the right values updated on the fee management based on the adjustment.

Revenue adjustment 606 compliance

If the ‘Auto-reverse contract cap adjustments’ option in the projects360 parameters is turned on, an automatic reversal is created for any previously posted adjustment and create a new revenue adjustments based off the current project balances. This auto-reversal functionality is applicable only for ‘From contract value cap’ method.

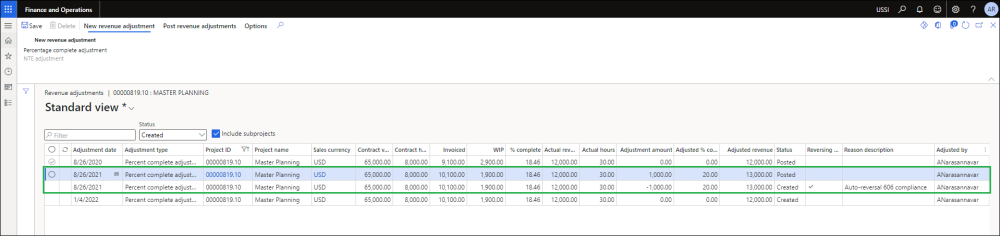

Here in the below screenshot, you can notice that second line in the grid is reversed through the third line. On the third line, ‘Reversing entry’ checkbox is marked and also there is a default reason description ‘Auto-reversal 606 compliance’ indicating this line is an auto-reversal.

If “Auto-reverse contract cap adjustments” parameter is set as “Yes”, and ‘Revenue adjustment competition method’ is set to ‘From contract cap’ and “Skip zero adjustment amount” is set as “Yes” on ‘Percentage complete adjustment’ process then it will skip creating the revenue adjustment for ‘adjustment amount’ zero and also it will not create any reversal entry for posted adjustments when there is no remaining balance to create a new adjustment.