Parameter Setup

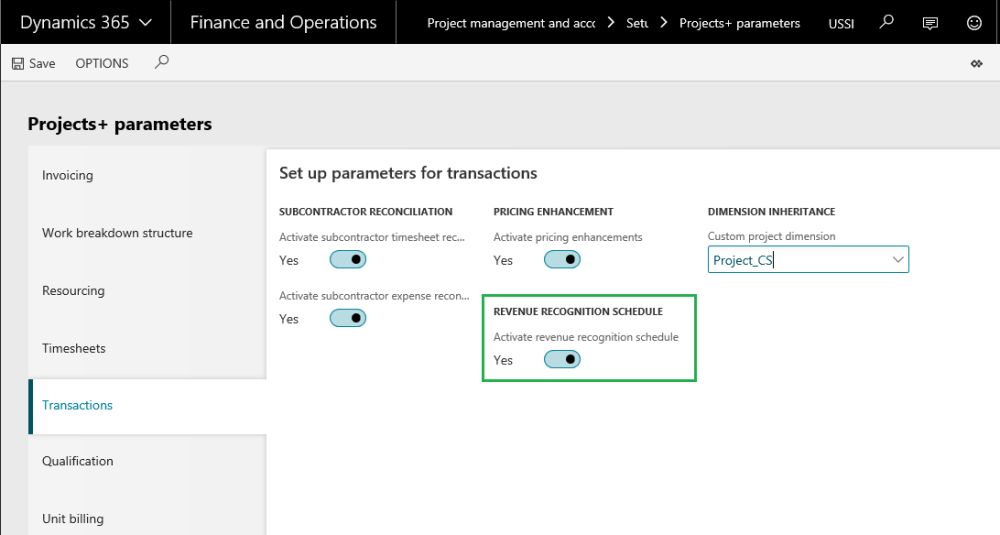

To activate the revenue recognition feature set the ‘Activate revenue recognition schedule’ option to Yes.

Go to Project management and accounting > Setups > projects360 parameters > Transactions tab

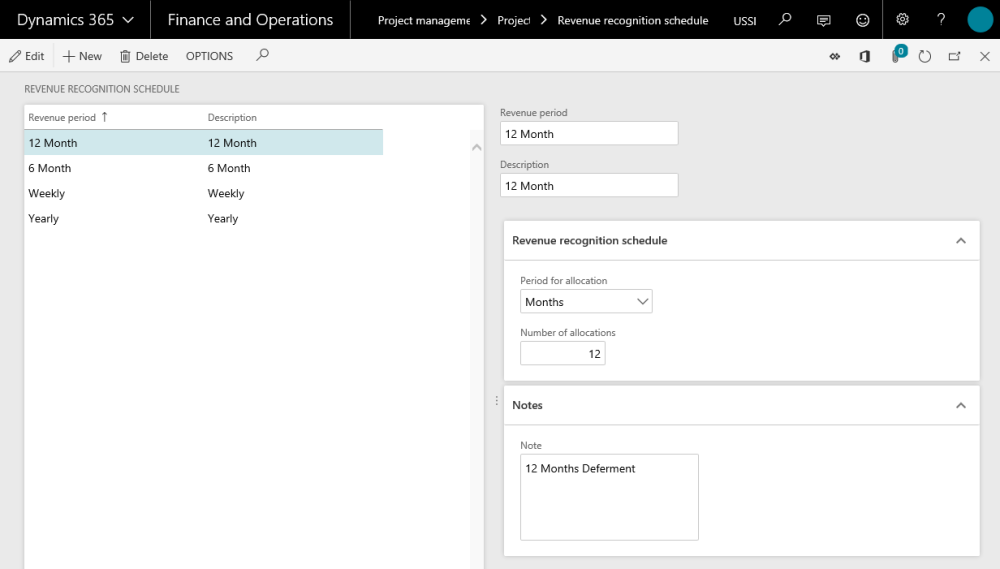

Revenue Recognition Schedule

Revenue Period is created to define the number of periods the user would like to defer the revenue received. The deferment schedule is attached to a fee journal for deferring the revenue received.

Go to Project management and accounting > Setups > projects360 Setup > Revenue recognition schedule

Description for some of the fields and buttons used on the form are as follows:

| Field/Button | Description |

| New | Click to create new deferred revenue ID. |

| Delete | Click to delete existing revenue period. |

| Revenue Period | Specify an identification of revenue recognition which will be used as the reference. |

| Description | Specify a description of the revenue period. |

| Period for allocation | Select the period for allocation. This defines installment is to be distributed in terms of weeks, months or years. |

| Number of allocations | Enter the number of periods for which the deferment is desired. |

| Notes | Specify a brief description or note for the revenue recognition. |

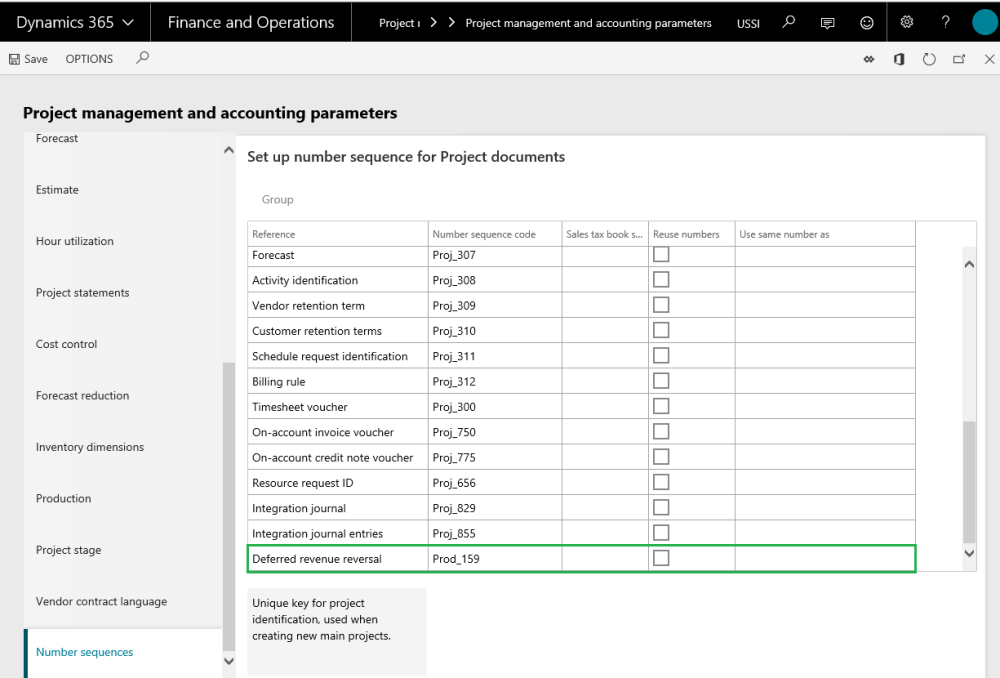

Number Sequence Setup

The revenue that is received is deferred over a period of time and when the actual revenue is posted per month, it is known as the deferred revenue reversal. For such a journal the number sequence has to be set up in the project management and accounting parameters form.

Revenue recognition reversal reference is added to the project management number sequence as soon as the user activates the Deferred revenue – Activate deferred revenue fee. Select the number sequence code for the reference – Deferred revenue reversal.

Go to Project management and accounting > Setups > Project management and accounting parameters

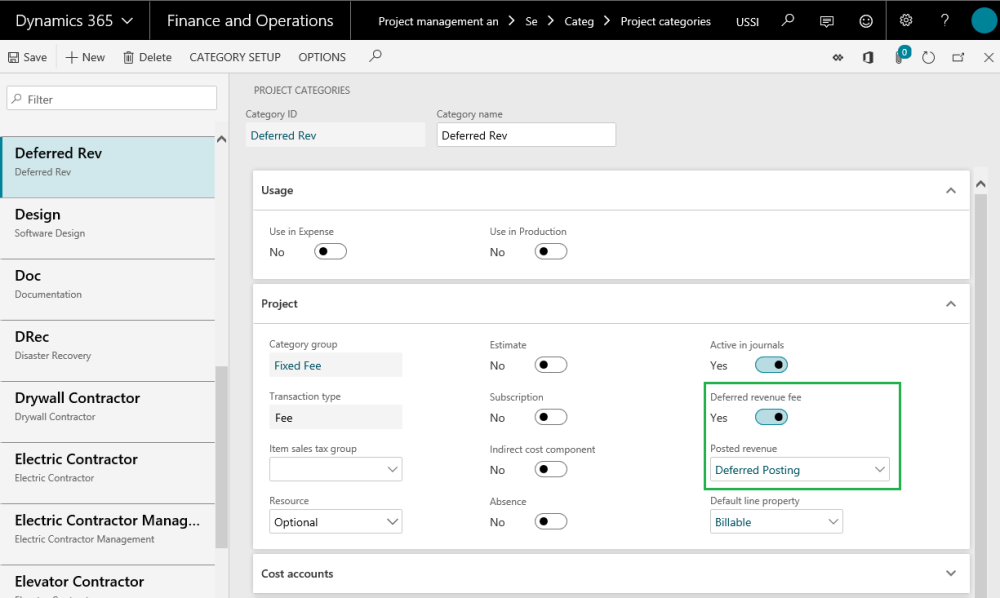

Fee Category Setup

On the Project categories form choose a fee category to set it as a deferred revenue category. Mark the option Deferred revenue fee to ‘Yes’. Note the the deferred revenue fee checkbox will be available for only fee type of category group and not to the hour, expense and item type of category groups. Once this option is set to ‘Yes’, the Posted revenue field is enabled and becomes a mandatory field. This field will allow the users to select another fee category which will be used to actual booking of revenue upon the deferment posting.

Go to Project management and accounting > Setups > Categories > Project categories > Select fee category

Define the below accounts in the fee categories to track the deferred and posted revenues:

Invoiced revenue – Deferred category

Accrued revenue sales value – Deferred category

Accrued revenue sales value – Posted revenue

The entries on posting of fee invoices would be as follows:

1. On invoicing the fee journal, the below entry would be generated as per standard.

| Customer balance account Dr. (Main account say 30040) | $1,000 | |

| Invoiced revenue (picked from deferred revenue category say 11040) | $1,000 |

2. When posting the deferment, the below entry would be generated.

| Accrued revenue – sales-value Dr. (deferred revenue category say 11040) | $100 | |

| Accrued revenue – sales-value (posted revenue category) | $100 |