A time and expense not to exceed (T&E NTE) contract includes a cap that represents the maximum amount that can be charged by the contractor. This type of contract or clause can help to increase contractor efficiency because the contract price is limited to the cap amount, no matter how long the project takes or how high the materials costs run.

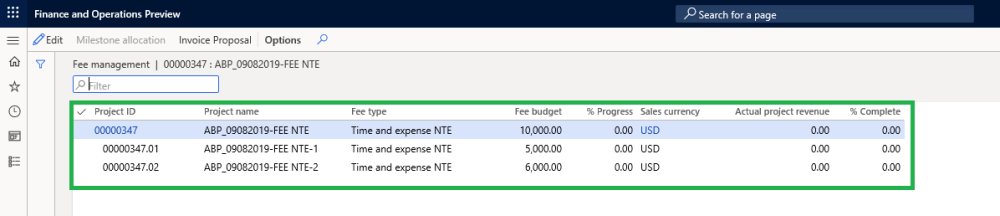

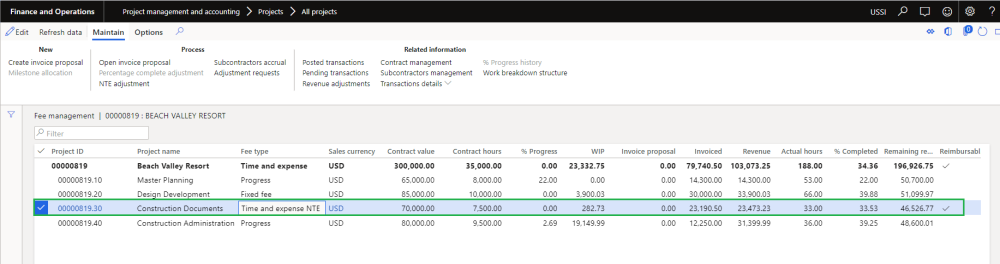

User will create new project with the project group of fee type “time and expense NTE” and when the user opens the fee management form, the line with fee type “Time and expense NTE” will get created and also a billing rule will be created on project contract with the contact value amount as zero automatically. Once the user updates contract value then a corresponding fee forecast lines will get automatically created on fee forecast form and billing rule will be automatically updated on project contract form with the contract value amount.

Projects and Fee type

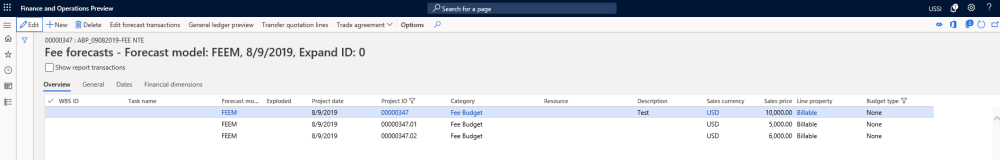

Fee forecasts

When the user defines Fee budget on the Fee management form, automatically fee forecast line with defined Fee budget amount will get created on fee forecast form.

Go to Project management and accounting > Projects > All projects > Fee forecast

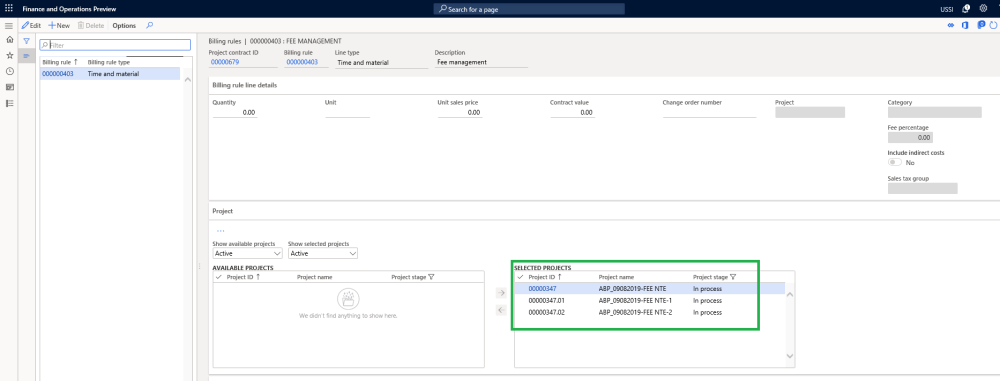

Billing rules on Project contract

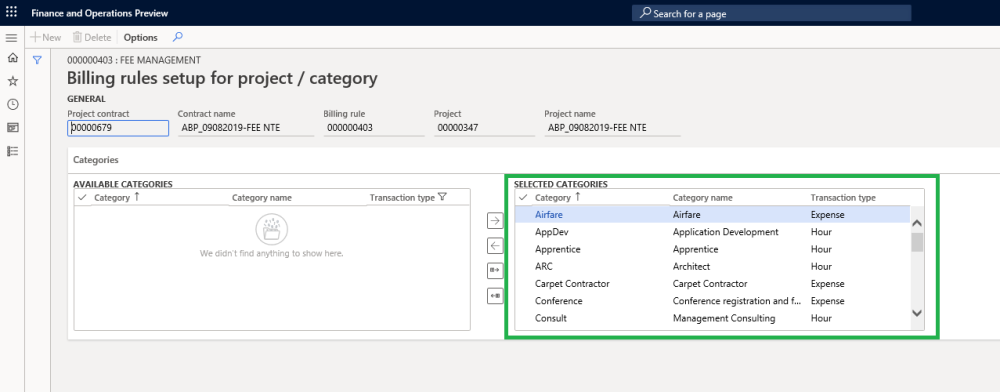

When the user defines Fee budget on the Fee management form, automatically billing rule line with defined Fee budget amount will get created on project contract form. Also the categories are added to chargeable categories.

Go to Project management and accounting > Projects > Project contracts

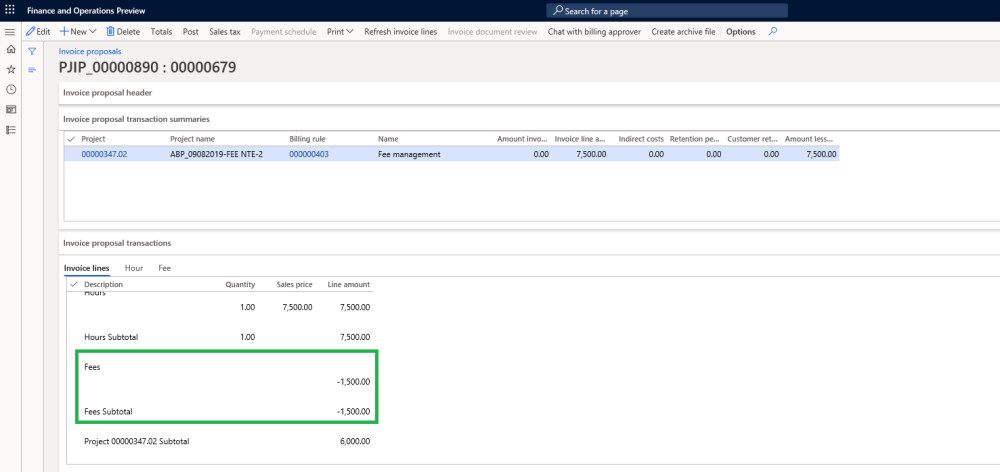

Project invoice proposals

User will go ahead and post the hours and expenses to the project. Once the transactions exceeds the budgeted fee amount, a negative fee journal will be created automatically for the differential amount while creating the invoice proposals.

Go to Project management and accounting > Projects > Project invoice proposal

Go to Project management and accounting > All Projects > Fee Management Tab -> Fee management button -> Create invoice proposal Button

Revenue adjustments

Revenue adjustments capabilities has been built on top fee management allowing us to adjust the accrued revenue getting the correct total revenue as well as WIP and % complete at given point of time. There could be scenarios where the actual work completed is more or less than then what’s been already billed to the client, in this case you can use the revenue adjustment capabilities bring back the project values to what’s expected.

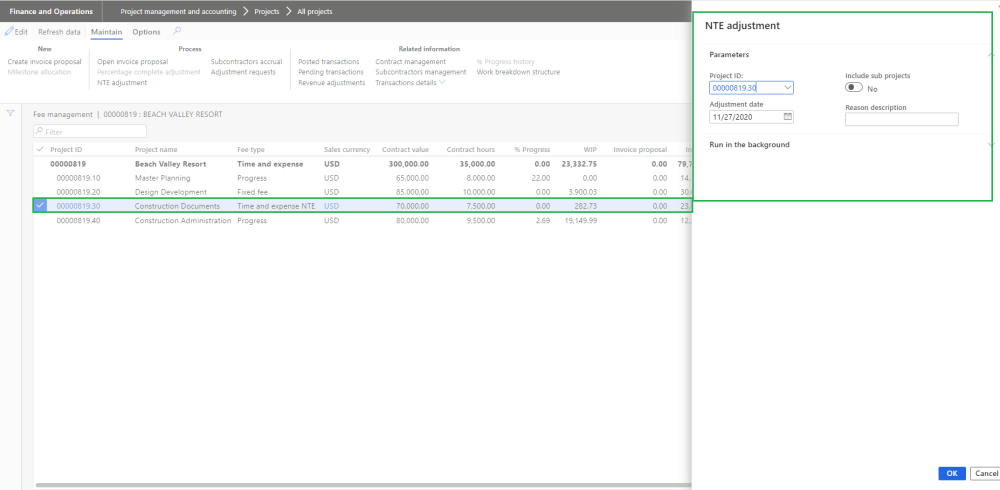

There are two type of the adjustments namely – percentage complete adjustment and NTE adjustment each catering to different fee types. Percentage complete adjustment is applicable to the projects with the fee type of progress or fixed fee where NTE adjustment is applicable to projects with the fee type of time and expense NTE.

Go to Project management and accounting > All Projects > Fee management -> NTE adjustment

Once user select time and expense NTE fee type project, NTE adjustment button is enabled allowing users to perform revenue adjustment.

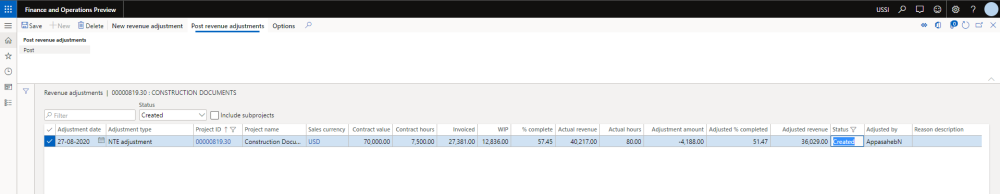

For NTE adjustments, calculations are straight forward. What value you see on the fee management form is brought into the revenue adjustment form and then we adjust the project balance by modifying the the ‘Adjustment amount’ and ‘Adjusted % completed’.

Once an adjustment record is created, user the modify the ‘Adjustment amount’ and ‘Adjusted % completed’ to adjust the project balances. On the modification, previously mentioned fields and the rest of the fields are auto calculated to reflect the right values. Once you sure of the adjusted values, you can post the revenue adjustments using button provided at the menu.

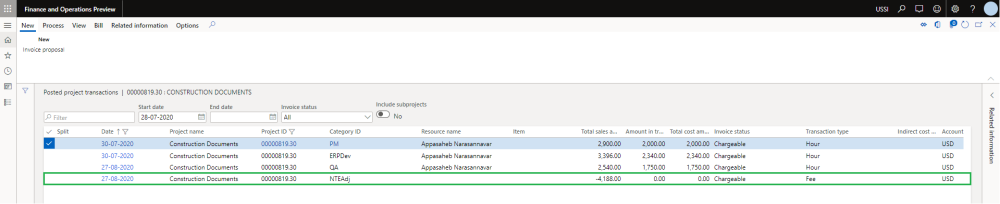

On posting a fee journal is created in system. The fee journal uses the category define on projects360 parameters.

Once the revenue adjustments are posted and complete, you can see the right values updated on the fee management based on the adjustment.