Subcontractor Accruals

On this form, there is a new process and form available to calculate subcontractor accruals based on “% progress” entered from “Fee management”. On this new form users can review the accrual proposal and post them as expenses. Those accrued expenses can be reversed at a later stage. This accrual and reversal process helps us in keeping the project balances up to date with the subcontractor progress.

To create the accrual proposal, we need to go to the below paths –

Project management and accounting > Projects > All projects/project details > “Contract management” tab > “Process” section > “Subcontractors accrual” button

Project management and accounting > Projects > Project contracts > “Contract management” tab > “Process” section > “Subcontractors accrual” button

“Contract management” form > “Subcontractors accrual” button

“Subcontractors management” form > “Subcontractors accrual” button

Project management and accounting > Projects360 periodic > Subcontractors management > Subcontractors accrual

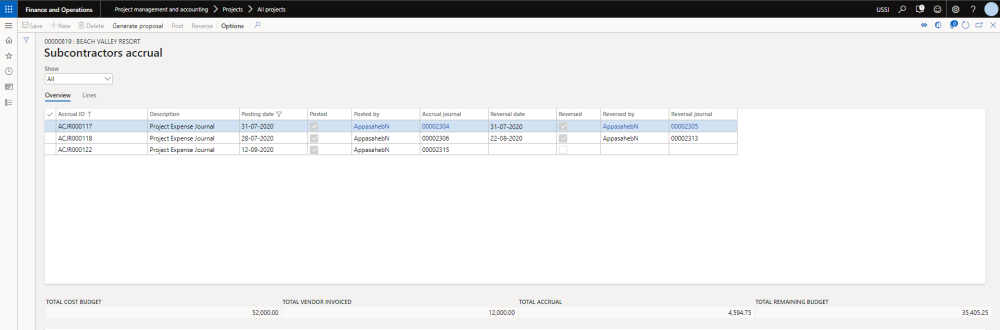

To create a new proposals, click on generate proposal button. A slide form pops up to create, enter the details and hit OK. Proposal generation process can be scheduled through the batch process as well. Once an accrual process is created, it displays in the overview grid. as seen in the below visual.

The details of the fields available on this form are as follows –

| Fields | Description |

| Accrual ID | This is a next number in the number sequence field configure on the parameters. |

| Description | This field show the details entered by the user during the proposal creation. If the user doesn’t change the description then it shows ‘Project Expense Journal’ |

| Posting date | Displays the posting date of the selected line. |

| Posted | Displays whether the the selected record is yet posted or not. |

| Posted by | Displays the details of the user who posted the selected line. |

| Accrual journal | Displays the accrual journal number. This is a hyperlink field, opens up the expense journal on clicking. |

| Reversal date | Displays the reversal date of the selected line. |

| Reversed | Displays if the selected line is yet reversed or not. |

| Reversed by | Displays the details of the user who reversed the selected line. |

| Reversal journal | Displays the accrual journal number. This is a hyperlink field, opens up the expense journal on clicking. |

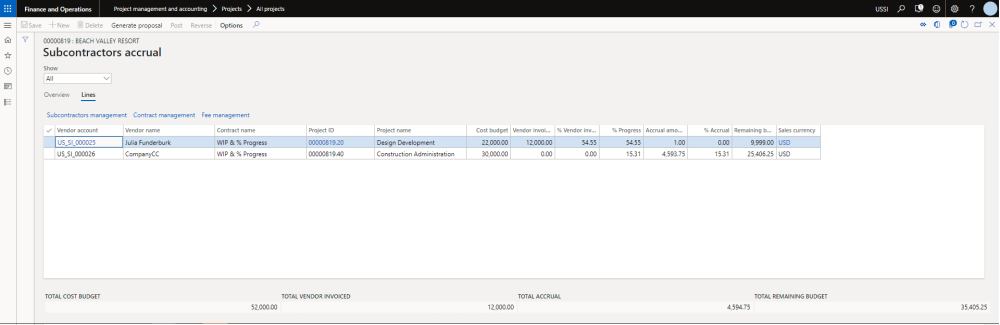

There is another tab on this form denoted as ‘Lines’, which shows the information as to from which subcontractor lines were considered for created accrual proposal and what are different projects were considered to create the proposal.

Details of the some of the fields available on this field are as follows -

| Fields | Description |

| Vendor account | This field shows the “Vendor account” from “Subcontractors management” table considered for creating a proposal. |

| Vendor name | Shows the vendor name of the selected vendor account on the line. |

| Contract name | Shows the project contract name of the selected on the line. |

| Project ID | Displays the Project ID from Subcontractors management table considered for creating a proposal. |

| Project name | Shows the project name of the selected project ID on the line. |

| Cost budget | Shows the sum of aggregated “Cost budget” field values for the specific vendor account and project ID. |

| Vendor invoiced | Shows the aggregated sales amount (cost price * Qty) from project expense transactions (ProjCostTrans) where project ID = Project ID and Transaction origin = vendor invoice related with the selected vendor account. Project expense transactions includes expense posted through Vendor invoice, project expense journal and general journal. |

| % Vendor invoiced | Calculated field showing vendor invoiced divided by cost budget multiplied by 100. |

| % Progress | Defaulted by % Progress field value from Fee management related with Project ID. If % Progress is zero, then it will be defaulted from % vendor invoiced. |

| Accrual amount | Calculated field showing (cost budget multiplied by % Progress divided by 100) minus vendor invoiced. |

| % Accrual | Calculated field showing accrual amount divided by cost budget multiplied by 100. |

| Remaining budget | Calculated field showing cost budget minus Vendor invoiced minus accrual amount. |

| Sales currency | Currency from project contract “Sales currency” field. |

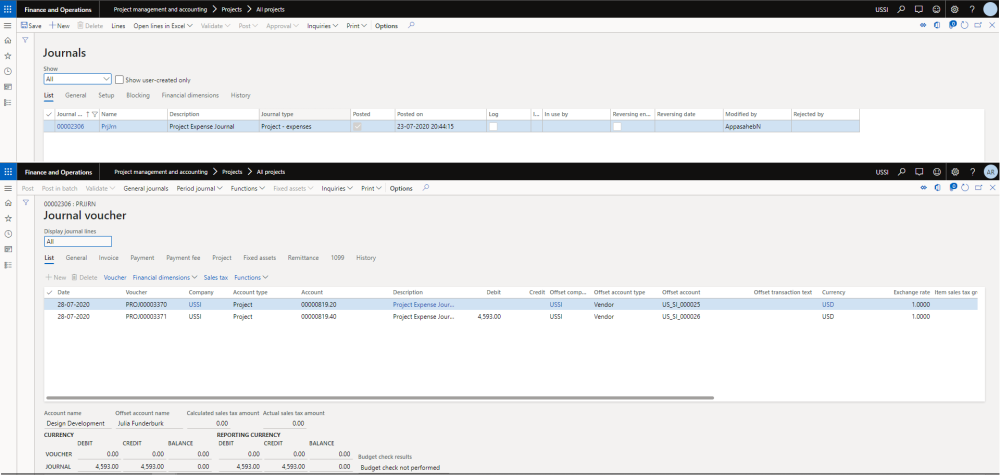

Accrual Journal Posting

Once the accrual journal is created, they are shown the form. These accrual journals create project expenses journals behind the scenes and can be directly posted from subcontractors accrual form or can be manually posted on the project expense journal form. This is controlled through the parameter on the projects360 parameters form.

| Note – The expense journal will get posted with offset account type will be as Ledger when the accrual offset account type is selected as Ledger and ledger account is defined on the parameters. |

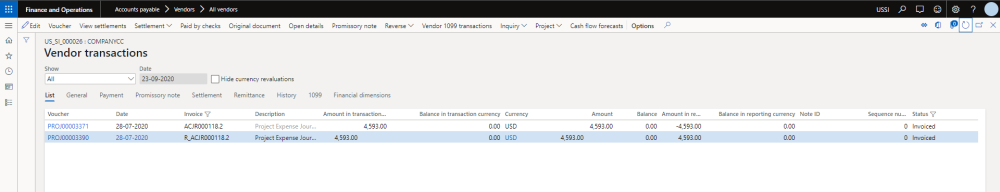

Accrual Journal Reversal

Posted accrual journal can be reversed at any point of time. Usually the reversals are performed once the actual vendor invoices hit our system. To perform the reversal just hit the reverse button on the form. This reversal process will negate the earlier posted accrual journal and also auto settle both the transactions.